With an Amortized Mortgage or Trust Deed Loan:

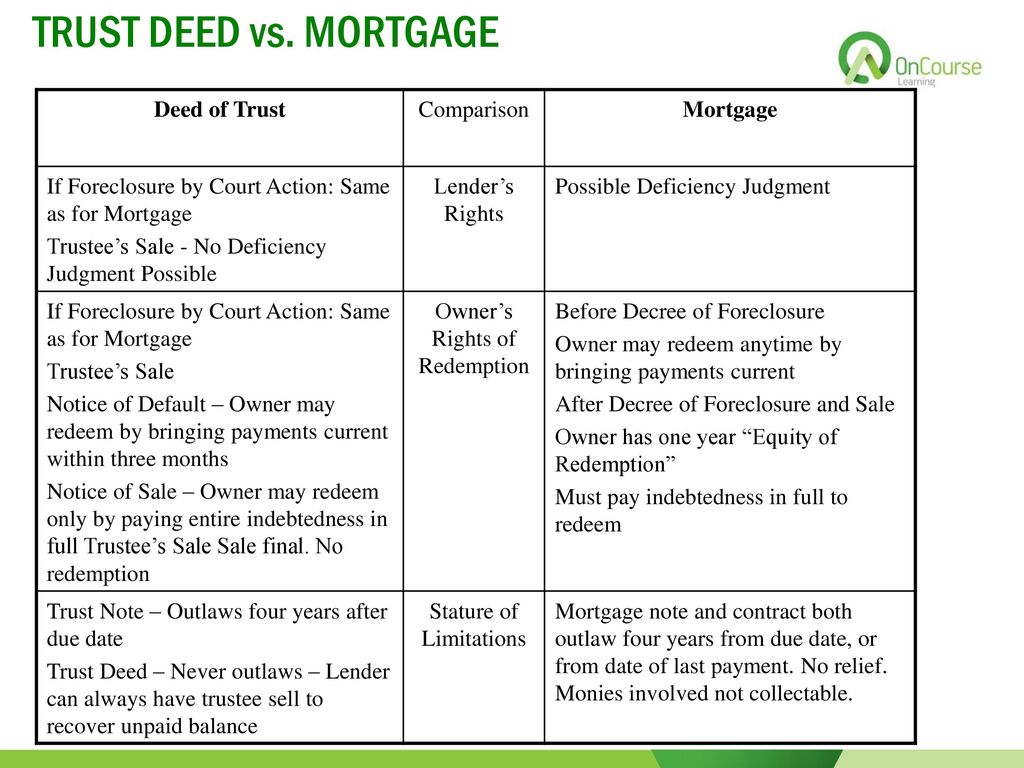

Deed of trusts differ from mortgages in that there are three parties involved. A Mortgage Deed also known as a Mortgage Agreement is a document where a borrower of money grants the lender of that money conditional ownership in a property as a security interest against the loan until the loan is paid in fullIf the borrower fails to repay the money as agreed the lender then becomes the owner of the property used as security and will.

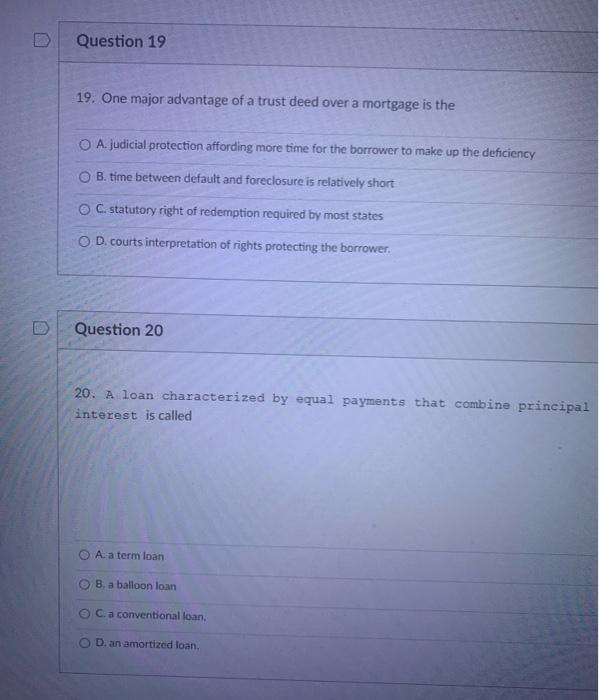

Solved Question 19 19 One Major Advantage Of A Trust Deed Chegg Com

The mortgage or deed of trust identifies ________.

. Most mortgage and deed of trust loans are amortized loans. Lien theory and title theory. Conveyance of Mortgage Loans.

The process of foreclosing on a home loan with a. Deeds of trust transactions are structured in the following five steps. In the case of a mortgage the mortgage servicer executes a power of attorney giving the attorney-in-fact the power to sell the property.

To use simply find the appropriate factor for the interest rate and number of years of your loan. Trustees exercise the power of sale in a foreclosure. Before using the deed to your home to secure a personal loan you should make sure that youve found a lender that you can trust and have gotten a good deal on the loan you want.

Trustee will be an agent of the beneficiary. The deed to your home can be used as collateral to secure a loan though care must be taken to avoid falling behind on your loan payments and potentially losing your house. Will service your trust deed investment for.

Please be sure to inquire as to the status. Assignment of Mortgage Loan Purchase Agreements a The Depositor concurrently with the execution and delivery hereof on the Closing Date does hereby establish a trust designated as DBJPM 2017-C6 Mortgage Trust appoint the Trustee as trustee of the Trust Fund and sell transfer assign set over and otherwise convey to the Trustee. Generally the rules when using a Deed of Trust allow for a faster foreclosure time than with a judicial foreclosure required with a mortgage.

The lender beneficiary the borrower trustor and the trustee. What if you dont own your home. Just like a mortgage trust deed also creates a lien against the property.

Computerized trust deed servicing takes all the fuss out of fully amortized partially amortized and interest only loans. Regular periodic payments are made over a term of years. A deed of trust is needed when a traditional lending service ie a bank is not being used or when certain states require deeds of trust instead of mortgages.

There will be 2 Notes and 2 Deeds of Trust or Mortgages. Dear Trust Deed Investor The following is a list of potential trust deeds that are currently available. The amortization rate expressed in years refers to how many years of monthly payments of principal and interest it will take for the borrower to pay the entire loan down to a zero balance.

Technically even if your house is mortgaged it is still owned by you however the mortgage is a loan that you pay back until the entirety of the loan is repaid. Multiply the factor by the loan amount to calculate your monthly payment. The borrower tenders the money to the seller.

For example a loan with 30 years of amortization means that if the buyer makes the minimum scheduled principal and interest rates the balance will be zero and the. A way to lower the initial interest rate on a mortgage or deed of trust loan. The most common periods are 15 or 30 years although 20-year mortgages are also available.

Available Trust Deeds. However the difference from a mortgages is that in case it comes down to a foreclosure the lender does not have to go to court. Therefore a 9 30 year fully amortized loan payment can easily be.

Whether you have a deed of trust or a mortgage they both serve to assure that a loan is repaid either to a lender or an individual person. That is they are paid off slowly over time in equal payments of principal and interest P I payments. Under a Deed of Trust when the borrower defaults on the loan the lender delivers the Deed of Trust to the trustee who then is instructed to sell the property.

Fully amortized loans have schedules such that the amount of your payment that goes toward principal and interest changes over time so that your balance is fully paid off by the end of the loan term. The loan amount on the documents will either be blank total 150 of your property value or 150 of the HUD Lending Limit. The table below will help you easily calculate a fully amortized monthly payment.

As always these trust deeds may be purchased in full or we may fractionalize them. Payment offsets interest rate and monthly payments during first few years. They do not secure a First and Second Lien the second Note and Deed only secure any advances that HUD may have to make to you after the lender stops and HUD begins.

Trust Deed Company has collected hundreds of millions of dollars for private investors since 1977. Straight line amortized mortgage 15 Simple interest Principal x interest rate x time 16 Charging interest in excess of rate set by state laws Usury 17. Lump sum paid in cash at closing.

Certainly the mortgage will need to be paid off during the trust administration but at least the cost and burdens of probate will be eliminated. There are two main theories of financing used in home lending. They may also be purchased through your IRAKEOUGH accounts or pension.

The lender gives the borrower money to buy a property. The decision between a short- or long-term loan should depend on your personal finances. As an example the factor for a 30 year 9 loan is 0080462.

In terms of the benefits a fully amortized loan gives certainty that youll be able to pay off the loan in monthly increments over time and fully pay off the loan by the end of. Some states follow what is called lien theory others follow what is called title theory and some states follow a hybrid of the two sometimes called. If deed of trust is executed instead of a mortgage lender will be beneficiary of the trust.

If you have a lot of monthly cash flow and you want to save on.

Chapter 12 Seller Financing In Tight Money Markets It S Not Uncommon For A Seller To Make A Deal To Finance Part Of The Purchase Price Mortgage Money Ppt Download

California Real Estate Principles 10 1 Edition Ppt Download

Term Loan Credit Agreement Dated As Of March 2 2020 By And Gs Acquisition Holdings Corp Business Contracts Justia

California Real Estate Principles 10 1 Edition Chapter

Contract For The Sale Of Residential Property Assuming Existing Loan And Giving Seller Purchase Money Mortgage Or Deed Of Trust Form Online Sellmyforms

California Real Estate Principles 10 1 Edition Ppt Download

Sample Printable Offer To Purchase Real Estate Pro Buyer Form Inside Free Hardware Loan Agreement Real Estate Forms Wholesale Real Estate Real Estate Templates

Trust Deed Investing Faq Mortgage Vintage

Alabama Real Estate Exam Finance Ppt Download

Real Estate Terms First United Land Transfer

What Is A Deed Of Trust Quicken Loans

Chapter 9 Real Estate Finance Loans Flashcards Quizlet

Pdf Printable Offer To Purchase Real Estate Pro Buyer Real Estate Estates Offer

Chapter 9 Real Estate Finance Loans Flashcards Quizlet

California Real Estate Principles 10 1 Edition Ppt Download

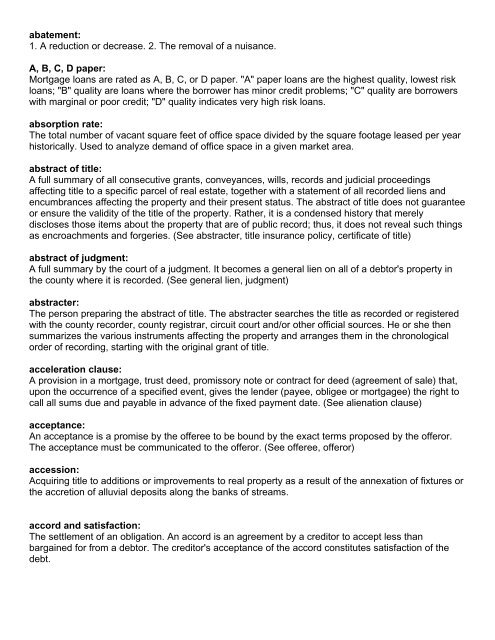

Real Estate And Mortgage Dictionary Family Services Inc

Amendment No 2 To Credit Agreement Dated December 18 2020 Team Inc Business Contracts Justia

Comments

Post a Comment